Sometimes, life throws a little curveball, and you find yourself needing a bit of extra help with your finances. Maybe it's an unexpected bill, or perhaps a chance to take care of something important that just can't wait. When these moments pop up, a small personal loan can seem like a really good idea, a way to bridge a gap, or just get things moving along. Many people wonder if their regular bank, like Chase, might be the place to turn for this kind of support.

Figuring out where to look for a bit of financial breathing room can feel a little bit like trying to find a specific train in a busy station, you know? You want something that fits your needs, something that feels reliable and straightforward. For many, thinking about their bank, a place they already trust with their money, makes a lot of sense. So, the question often comes up: what about Chase Bank and those smaller personal loans?

This whole idea of getting a loan, even a small one, brings up a lot of thoughts. It's not just about the money itself; it's about what that money helps you do, or what problem it helps you solve. It's about feeling a bit more secure, or having the means to handle something that's been weighing on your mind. We'll try to unpack what it might mean to consider Chase Bank for a small personal loan, and what sorts of things you might want to think about along the way, in a way that feels pretty direct and easy to follow.

- Iot Virtual Private Cloud

- Slime Krew Members

- Is Bamboo Healthy To Eat

- Pining For Kim Trailblazer Full Animation Free

- Bamboo Shoot Health Benefits

Table of Contents

- What Are Small Personal Loans Anyway?

- Does Chase Bank Offer Small Personal Loans?

- How Do You Apply for Chase Bank Small Personal Loans?

- When Might You Need a Small Personal Loan?

- Thinking About Your Chase Bank Small Personal Loans Repayment

- What Else Should You Consider with Chase Bank Small Personal Loans?

- Other Options Instead of Chase Bank Small Personal Loans

- Making Smart Choices About Your Money

What Are Small Personal Loans Anyway?

A small personal loan, you know, is basically a sum of money you borrow from a bank or a similar financial place. You get the whole amount all at once, and then you pay it back over time, usually with a little extra on top for the privilege of borrowing it. This extra bit is called interest. The "small" part just means it's not a huge amount, perhaps a few thousand dollars, something like that. It's often used for things that aren't big purchases like a house or a car, but more for life's everyday needs or maybe a surprise expense that pops up. So, it's pretty much money for personal use, which you then pay back in regular, scheduled payments, often monthly, until the whole thing is settled. It's a pretty common way for people to handle different money situations, actually.

People look into these kinds of loans for all sorts of reasons, and that's just it. Sometimes, it's about consolidating a few smaller debts into one easier payment, which can make things feel a bit less scattered. Other times, it's for something like a home repair that just can't wait, or maybe even an important medical bill. The money isn't tied to a specific item, like a car loan is to a car, so you have a bit more freedom with how you use it. This flexibility is, in some respects, one of the main draws. It's about getting a sum of money to use as you see fit, and then having a clear plan for paying it back. It's a pretty straightforward idea, really, when you get down to it.

When you think about getting one of these loans, you're essentially making a promise to pay back the money you borrow, plus the cost of borrowing it, over a set period. Banks look at things like your credit history – how well you've handled money in the past – and your income to decide if they'll lend to you and what terms they'll offer. It's a way for them to figure out the risk involved, of course. So, if you've been good about paying bills on time, that usually helps your chances. It’s a pretty simple exchange, money now for a promise to pay later, with a little extra for the trouble. That’s basically how it works, more or less.

- Raspberry Pi Remote Management Mac

- Pining For Kim By Trailblazer Animation

- Kemuri Garcia

- 50 Years Old

- T%C3%BCrk If%C5%9Fa Sptwe

Does Chase Bank Offer Small Personal Loans?

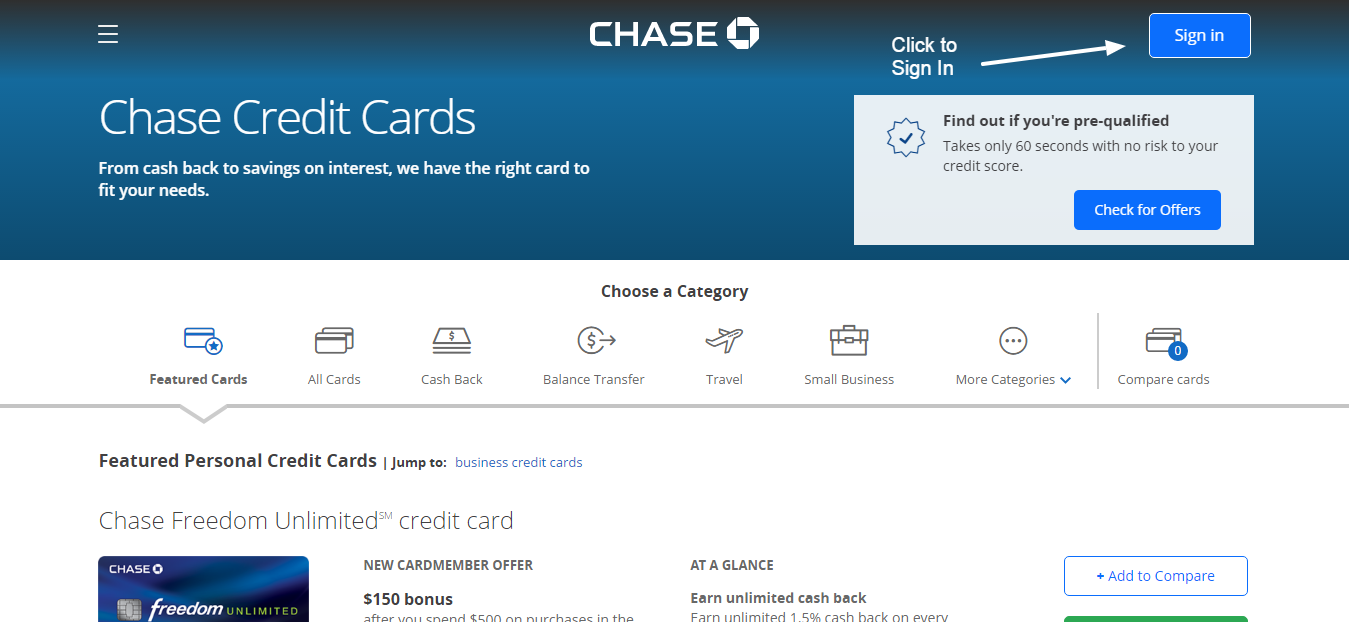

Now, when it comes to Chase Bank and small personal loans, things can be a little bit interesting. Historically, Chase has focused more on other types of lending for individuals, like mortgages, auto loans, and credit cards. Direct, unsecured personal loans, the kind you might think of as a general-purpose loan that isn't tied to an asset, haven't always been their primary offering for everyone. That's not to say they don't have ways for customers to get money; it's just that their approach might be a bit different from what you'd expect from a bank that heavily advertises personal loans. So, if you're looking for something specific, you might find their options present themselves in a slightly different form. You know, like how sometimes a train might take a slightly different route than you expected but still gets to the same destination.

For existing Chase customers, there are often ways to access funds that might serve a similar purpose to a small personal loan. For example, they might offer lines of credit, which give you access to a certain amount of money you can draw from as needed, paying interest only on what you use. Or, sometimes, they might have specific loan products that are tied to certain accounts or for particular purposes, even if they're not labeled as a general "personal loan." It's really about checking with them directly to see what current options are available for your specific situation. They might have something that fits just right, actually, even if it's not the exact name you had in mind for a Chase Bank small personal loan.

It's always a good idea to speak directly with someone at Chase or check their official website for the most current and accurate information regarding any small personal loans or similar financial products they might have. What's available can change, and what one person qualifies for might be different for another. Your relationship with the bank, your financial history, and other factors can play a part. So, if you're seriously thinking about getting some money from Chase, your best bet is to go straight to the source and ask them what they have that could help you out. That's really the most direct way to get the real scoop, you know?

How Do You Apply for Chase Bank Small Personal Loans?

If you're looking to apply for something like a small personal loan with Chase, the first thing you'll probably want to do is gather up some of your personal financial details. This typically includes things like proof of your identity, like a driver's license, and information about your income, perhaps recent pay stubs or tax documents. They'll also want to know about your living situation, like where you live and how long you've been there. It's all pretty standard stuff that banks ask for to get a good picture of your financial standing. So, having these bits of information ready can make the process go a bit smoother, apparently.

Next, you'd likely head to their website or visit a local branch. Many banks now offer online applications, which can be pretty convenient. You fill out a form with all your information, and then they'll typically do a check on your credit history. This check helps them see how you've handled money in the past, like if you pay your bills on time. They use this to decide if they'll approve you for the loan and what the terms of that loan might be. It's a pretty important step in the whole process, you know, for getting those Chase Bank small personal loans, or whatever similar product they might offer.

After you submit your application, there's usually a waiting period while they review everything. Sometimes, they might need a little more information from you, and they'll reach out to ask for it. If you're approved, they'll let you know the loan amount, the interest rate, and how long you have to pay it back. Then, if you agree to the terms, the money is usually deposited directly into your bank account. It's a pretty straightforward sequence of steps, really, from thinking about it to actually getting the funds you need. That's how it generally works, more or less.

When Might You Need a Small Personal Loan?

There are many times in life when a small personal loan can feel like a really helpful hand. Maybe your car suddenly needs a big repair, and you rely on it for work. Or perhaps there's a sudden medical expense that wasn't planned for. These are the kinds of unexpected costs that can pop up and put a real squeeze on your budget. A small loan can help you cover these things without completely emptying your savings or having to put off something truly important. It's about having that little bit of financial flexibility when you need it most, you know? It's like having a backup plan for those moments that catch you a little off guard.

Sometimes, it's not about an emergency, but about something that improves your life or helps you get ahead. Maybe you want to take a short course to learn a new skill, or you have a small home improvement project that would really make a difference to your living space. These aren't necessarily urgent, but they can be important for your well-being or future prospects. A small personal loan can provide the funds to pursue these kinds of opportunities without having to wait for months or years to save up. It's a way to invest in yourself or your home, in a way, that can pay off in the long run. So, it's pretty versatile, really.

Another common reason people consider these loans is to simplify their existing debts. If you have a few different credit card balances, for instance, each with its own interest rate and payment due date, it can feel a bit overwhelming. A personal loan can sometimes be used to pay off all those smaller debts, leaving you with just one monthly payment at a single interest rate. This can make managing your money much simpler and, in some cases, even save you money on interest over time. It's like tidying up your financial picture, making it much clearer and easier to handle. That's a pretty appealing thought for many people, honestly.

Thinking About Your Chase Bank Small Personal Loans Repayment

Once you've got a small personal loan, the next big thing to think about is paying it back. This is where the commitment comes in. You'll have a set schedule of payments, usually monthly, and it's really important to stick to that schedule. Each payment typically covers a bit of the original amount you borrowed, plus the interest. Making these payments on time is a big deal for your financial health. It helps keep your credit standing strong, which can be useful if you ever need to borrow money again in the future. So, being consistent with your Chase Bank small personal loans payments is something you'll want to prioritize, definitely.

Before you even agree to a loan, it's a good idea to look closely at the repayment schedule and make sure it fits comfortably into your budget. You don't want to stretch yourself too thin, or find yourself struggling to make ends meet because of a loan payment. Think about your regular income and all your other expenses. Can you realistically afford the monthly payment without feeling too squeezed? It's better to be honest with yourself upfront than to get into a situation where you're constantly worried about making the next payment. That's a pretty important step, you know, in planning for any loan.

Sometimes, life happens, and you might find yourself in a situation where making a payment becomes difficult. If that ever happens, the best thing to do is communicate with your bank as soon as possible. They might have options or solutions that could help you through a tough spot, like adjusting your payment plan temporarily. Ignoring the problem or missing payments can have pretty serious consequences for your credit history. So, keeping an open line of communication is key. It's like when you're out running and you spot a potential obstacle; you address it head-on rather than hoping it just disappears, you know? That's really the way to handle it.

What Else Should You Consider with Chase Bank Small Personal Loans?

When you're looking at getting a small personal loan, whether it's from Chase Bank or somewhere else, there are a few other things that are really worth thinking about. One of the big ones is the interest rate. This is the cost of borrowing the money, expressed as a percentage. A lower interest rate means you pay less extra money over the life of the loan. So, it's definitely something you want to pay close attention to. A difference of even a few percentage points can add up to a good bit of money over time, so it's worth looking into that very carefully.

Another thing to consider is any fees that might be involved. Some loans have an origination fee, which is a charge for processing the loan. There might also be late payment fees if you miss a due date. It's important to ask about all possible fees upfront so you know the full cost of the loan. You don't want any surprises down the road. Knowing all the costs involved gives you a much clearer picture of what you're getting into, you know? It's like knowing all the stops on a train route before you get on board, essentially.

Finally, think about the loan term – how long you have to pay the money back. A shorter term usually means higher monthly payments, but you pay less interest overall. A longer term means lower monthly payments, but you'll pay more interest because you're borrowing the money for a longer period. Finding the right balance between a manageable monthly payment and the total cost of the loan is pretty important. It's about finding what feels right for your personal situation and what you can comfortably handle. So, that's definitely something to weigh carefully when considering Chase Bank small personal loans or any similar option.

Other Options Instead of Chase Bank Small Personal Loans

If a direct personal loan from Chase doesn't quite fit what you're looking for, or if you just want to explore all your possibilities, there are other ways to get a bit of financial help. One common choice is a credit union. These are member-owned financial places, and they sometimes offer personal loans with pretty competitive rates, especially if you're already a member. They often have a more community-focused feel, and their lending decisions can sometimes be a bit more flexible than bigger banks. So, that's one avenue worth exploring, you know, if you're weighing your choices.

Another option that many people consider is online lenders. There are a lot of companies out there that specialize in personal loans and operate entirely online. They can sometimes offer a quick application process and fast funding, which can be really appealing if you need money quickly. However, it's super important to do your homework and make sure any online lender you consider is reputable and has clear terms. Not all online lenders are the same, so you'll want to be careful and read reviews. That's a pretty crucial step, actually, to avoid any unpleasant surprises.

For smaller amounts, sometimes a credit card cash advance might seem like an option, but this usually comes with very high interest rates and fees right from the start. It's generally not the most cost-effective way to borrow money unless it's a very small amount for a very short time. Also, if you own your home, a home equity loan or line of credit could be a possibility, but these use your home as collateral, which means your home is at risk if you can't pay it back. So, while these exist, they come with their own set of considerations and risks that are important to understand. It's a bit like choosing between different paths; some are more direct, but others might have hidden turns, you know?

Making Smart Choices About Your Money

Ultimately, making choices about borrowing money, even small personal loans from a place like Chase Bank, is about making smart decisions for your own financial well-being. It's not just about getting the money; it's about what happens after that. Thinking ahead, planning how you'll pay it back, and understanding all the terms involved are really important steps. It's like planning a trip; you want to know your destination, how you'll get there, and what it will cost. That way, you can feel confident and prepared, rather than just hoping for the best. So, being thoughtful about it can make a big difference, definitely.

Taking the time to compare different options, even if you think you know where you want to get your loan, can be really beneficial. Look at interest rates, fees, and repayment terms from a few different places. What one bank offers might be slightly different from another, and those differences can add up. It's like shopping around for a good deal; you want to make sure you're getting the best fit for your needs and your budget. So, a little bit of research can go a long way, honestly, when you're thinking about something as important as your money.

Remember, a loan is a tool, and like any tool, it can be very helpful when used correctly. It can provide a solution to a temporary financial need or help you achieve a goal. But it also comes with responsibilities. Being realistic about your ability to repay and choosing a loan that truly fits your circumstances are key. It's about being in control of your money, rather than letting your money control you. That's a pretty powerful feeling, you know, when you're managing things well. It’s essentially about making choices that feel right for your life, both now and in the future.

- Bamboo Nutrition Value

- Can You Remote Into A Raspberry Pi

- Geoffry Lewis

- T%C3%BCrk Ifla Sotwe

- Raspberry Pi Remote Management Mac