Finding the right money solution for your personal needs can sometimes feel like a real quest, a bit like looking for something special that doesn't come along every day. Whether you are thinking about making a big purchase, consolidating some bills, or simply need some extra funds for life's unexpected moments, a personal loan might be something you are considering. It is a way to get a lump sum of cash, which you then pay back over a set period, usually with interest added on top. The trick, you see, is to find one where that interest part is as small as it can be. That is where the idea of seeking out low interest personal loans truly comes into play, as it means less money you pay back overall.

When you are thinking about borrowing money, the cost of that borrowing, the interest rate, is a very big deal. A lower interest rate means your monthly payments are often more manageable, and the total amount you give back to the lender is less. It is, in a way, like getting a better deal on something you really want. So, people often put a lot of effort into finding loans that come with these smaller interest charges. It is not just about getting the money; it is about getting it on terms that make sense for your own financial picture. This kind of careful searching, you know, can really make a difference in your financial well-being over time.

This discussion will walk you through what personal loans are all about, why getting a low interest rate is so valuable, and how certain things, like your credit history, play a part. We will also talk about how to get ready to ask for a loan and what you might find when you look at options from places like Chase for low interest personal loans. It is all about giving you some thoughts to help you make choices that feel right for you and your money situation. So, we will look at how to approach this whole process with a clear head, and what kinds of things you can do to put yourself in a good spot to secure money when you need it.

Table of Contents

- What Exactly are Personal Loans?

- Why Pursue Low Interest Personal Loans?

- How Does Your Credit Score Affect Chase Low Interest Personal Loans?

- What Steps Can Help You Secure a Good Loan Rate?

- Looking at Chase Low Interest Personal Loans - What to Expect?

- Are There Other Ways to Get a Good Loan?

- How to Prepare for a Personal Loan Application?

- Summary of Loan Considerations

What Exactly are Personal Loans?

A personal loan is, at its heart, a type of money borrowed for your own personal use, rather than for a house or a car specifically. You get a set amount of cash all at once, and then you pay it back, typically in regular payments, over a period that you and the lender agree upon. These payments usually stay the same each time, which can make it easier to plan your budget. People use these loans for all sorts of things, you know, like paying for home improvements, covering a wedding, or even taking a well-deserved trip. It is a very flexible way to get funds for many different life events. So, it is not tied to one specific purchase, which makes it pretty adaptable for many situations where you might need a little financial help.

One of the main things about personal loans is that they are often unsecured. This means you do not have to put up something valuable, like your house or your car, as a promise to pay the money back. This is different from a mortgage or a car loan, which are secured by the item you are buying. Because there is no item to take if you do not pay, lenders often look very closely at your ability to pay back the loan, and your past payment history, before they agree to give you the money. This is why things like your credit standing become so important when you are trying to get a personal loan. It is, in some respects, about trust between you and the money provider.

The money you get from a personal loan goes directly into your bank account, which is pretty convenient. Once it is there, you can use it for whatever you said you would use it for, or sometimes even for something else, depending on the loan agreement. The time you have to pay it back, often called the loan term, can be anywhere from a couple of years to seven years, sometimes even longer. The length of time you have to pay it back will affect how much your monthly payments are. A longer term might mean smaller monthly payments, but you might end up paying more in interest over the whole time. It is a balance you need to think about, you know, when you are figuring out what works best for your wallet.

- Device Management Remote Iot Management Platform Examples

- T%C3%BCrk If%C5%9Fa Stowr

- Jalen Hurts

- How To Use Remote Desktop To Raspberry Pi From Mac

- Best Remote Iot Monitor Device

Why Pursue Low Interest Personal Loans?

The main reason anyone would want to chase low interest personal loans is pretty straightforward: it saves you money. When you borrow cash, the interest is the extra fee you pay for the privilege of using someone else's money. If that fee is smaller, then the total amount you have to give back is less. Think about it this way: if you borrow a certain amount, say ten thousand dollars, and the interest rate is high, you could end up paying back many thousands more than you originally borrowed. But if the rate is low, that extra amount you pay could be significantly smaller. It is like getting a discount on the act of borrowing itself, which, you know, is always a good thing for your personal finances.

Lower interest rates also mean that your regular payments, the ones you make each month, are usually smaller. This can make it much easier to fit the loan payments into your everyday budget. If your payments are too big, it can put a strain on your other expenses, making it hard to pay for groceries, rent, or other bills. So, having a more comfortable monthly payment amount can really help you stay on top of your finances and avoid stress. It gives you more breathing room, so to speak, in your money management. This is why people often spend time looking for the best possible rate, because it truly impacts their daily financial life.

Another thing to think about is how a low interest loan can help you pay off other, more expensive debts. Many people use personal loans to bring together, or consolidate, their credit card balances. Credit cards often come with very high interest rates, sometimes twenty percent or more. If you can get a personal loan with a much lower rate, say eight or ten percent, you can use that loan to pay off your credit cards. Then, you only have one payment to make, and it is at a much lower interest cost. This can save you a lot of money over time and help you get out from under those higher interest bills much faster. It is, in a way, a clever move to simplify and save, which is pretty smart when it comes to money.

How Does Your Credit Score Affect Chase Low Interest Personal Loans?

Your credit score is, basically, a number that tells lenders how good you are at paying back money you have borrowed in the past. It is a big deal when you are trying to get any kind of loan, especially when you are trying to secure low interest personal loans. A higher credit score tells banks and other money providers that you are a reliable person when it comes to debts. They see you as less risky, and because of that, they are more willing to offer you better deals, which includes lower interest rates. It is, you know, like having a good report card for your money habits, and that good report card gets you better terms.

On the flip side, if your credit score is not as high, lenders might see you as more of a risk. This means they might still offer you a loan, but the interest rate they give you will likely be higher. They do this to make up for the extra risk they believe they are taking by lending to someone with a less stellar payment history. So, if you are hoping to get a really good rate, putting some effort into making your credit score stronger before you apply can be a very smart move. It is, after all, about showing them you are a safe bet, which can really help you get a good deal on your chase low interest personal loans.

Things that go into your credit score include whether you pay your bills on time, how much debt you already have, how long you have had credit accounts open, and the different kinds of credit you use. Paying every bill when it is due is probably the most important thing you can do. Keeping your credit card balances low compared to your credit limits also helps a lot. Checking your credit report regularly for any mistakes is a good idea too, because even small errors could make your score look worse than it really is. All these small steps, you know, can add up to a much better score, which in turn helps you get a better interest rate when you want to chase low interest personal loans.

What Steps Can Help You Secure a Good Loan Rate?

To really boost your chances of getting a good rate on a personal loan, there are a few things you can do to prepare. First off, get a clear picture of your current credit standing. You can get a free copy of your credit report from each of the main reporting companies once a year. Look it over carefully for any errors, because correcting those could give your score a little lift. Knowing your score gives you a starting point, so you know what kind of rates you might realistically be offered. It is, you know, like checking the weather before you head out, so you know what to expect.

Next, try to pay down any existing debts you have, especially those with high interest rates, like credit cards. When you reduce your overall debt, your credit usage ratio improves, which can make your credit score go up. This shows lenders that you are not stretched too thin financially and that you have a good handle on your money. A lower debt load also makes you look less risky to lenders, which can definitely help you get a better interest rate on your chase low interest personal loans. It is, in a way, about making your financial house look tidy and well-managed.

Another helpful step is to have a clear idea of how much money you actually need and what you plan to use it for. Lenders like to see that you have a specific plan for the funds. Also, think about how much you can comfortably afford to pay back each month. Do not just borrow the maximum amount offered if you do not truly need it, because that means more interest and potentially higher payments than you can handle. Planning this out ahead of time shows you are a thoughtful borrower, which can sometimes make a difference in the terms you are offered. It is, you know, about being prepared and showing responsibility.

Looking at Chase Low Interest Personal Loans - What to Expect?

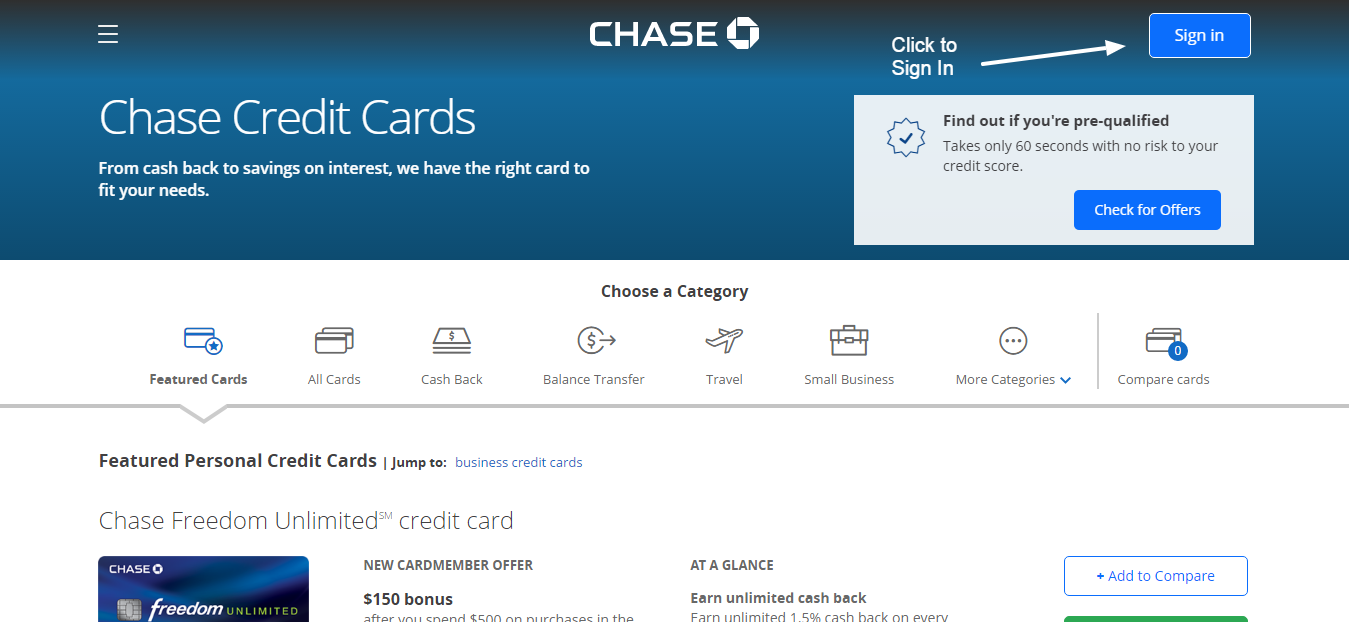

When you start looking at big banks like Chase for personal loans, you will find they have a certain way of doing things. They often have very clear guidelines for who they will lend money to and at what rates. Because they are such a large financial institution, they tend to offer competitive rates to people with very strong credit histories. If your credit score is high, and you have a good record of paying bills on time, you might find their offers for chase low interest personal loans to be quite appealing. It is, in a way, like a reward for being a good money manager over time.

Chase, like many large banks, usually has an online application process, which can be pretty convenient. You can often get an idea of what rate you might qualify for without it affecting your credit score right away, through what is called a "soft inquiry." This lets you shop around a bit without any harm to your credit standing. If you decide to go ahead with a full application, then they will do a "hard inquiry," which does show up on your credit report, but it is a necessary step to get the actual loan. So, you know, it is good to understand these differences when you are just starting your search for chase low interest personal loans.

What you can expect from Chase in terms of actual interest rates will depend a lot on your own financial situation, as we talked about earlier. They will look at your income, your debt-to-income ratio, and your credit score. They might also have specific requirements for how much you can borrow and for how long you can take to pay it back. It is always a good idea to read all the fine print very carefully before you agree to anything. Make sure you understand all the fees, the payment schedule, and what happens if you miss a payment. Being fully informed is, you know, a very smart way to approach any financial agreement, especially when you are seeking chase low interest personal loans.

Are There Other Ways to Get a Good Loan?

While big banks like Chase are a common place to look, they are certainly not the only option when you are trying to find low interest personal loans. There are many online lenders that specialize in personal loans, and sometimes they can offer very competitive rates, especially if your credit is strong. These online companies often have a faster application process, and you might even get the money in your account quicker than with a traditional bank. It is, you know, a different way of doing things, sometimes more streamlined for today's pace of life.

Credit unions are another place worth checking out. These are member-owned financial groups, and they often have a reputation for offering more personal service and sometimes better rates than larger banks, especially for their members. They might be more willing to work with you if your credit history is not absolutely perfect, too. You usually need to become a member to borrow from a credit union, but joining is often pretty simple. So, if you are looking for a potentially friendly option for chase low interest personal loans, a local credit union could be a good starting point.

Peer-to-peer lending platforms have also become an option. With these, you borrow money from individual investors rather than a bank or credit union. The rates you get can vary a lot, depending on your credit and the specific investors. It is a bit like a marketplace for loans. Sometimes, you might find a very good deal there, but it is important to do your homework and understand how these platforms work. So, you know, there are many paths to finding the money you need, and it is worth exploring a few different ones to see what fits your situation best when you are trying to secure chase low interest personal loans.

How to Prepare for a Personal Loan Application?

Getting ready to apply for a personal loan means gathering some important papers and information. Lenders will typically ask for proof of your identity, like a driver's license or passport. They will also want to see proof of your income, which could be recent pay stubs, tax returns, or bank statements. This helps them confirm that you have a steady way to pay back the loan. It is, you know, about showing them you are financially stable and capable of handling the new debt you are taking on.

You will also need to provide details about your current debts and expenses. This includes things like your rent or mortgage payments, other loan payments, and credit card balances. Lenders look at this to figure out your debt-to-income ratio, which is how much of your monthly income goes towards paying off debts. A lower ratio usually means you are in a better position to take on more debt. So, having a clear picture of all your financial commitments before you apply is a very good idea when you are thinking about chase low interest personal loans.

Finally, know exactly how much you want to borrow and for what purpose. While personal loans are flexible, having a clear plan helps you choose the right amount and repayment schedule. Be prepared to explain why you need the money and how you plan to use it. This shows the lender you are serious and have thought things through. It is, you know, like going into a meeting with a clear agenda, which always makes a good impression. Being organized and clear about your needs can certainly help the application process for chase low interest personal loans go more smoothly.

Summary of Loan Considerations

This discussion has touched on several aspects of personal loans, particularly when you are aiming for low interest personal loans. We looked at what these loans are, how they offer a sum of money for various personal uses, and how they are often unsecured. The value of a low interest rate was clear, as it means less money paid back overall and more manageable monthly payments. We also saw how a good credit score is very important for getting those better rates, acting as a kind of financial report card that lenders look at closely. So, you know, your past payment habits really matter here.

We also talked about the steps you can take to put yourself in a good spot for a loan, such as checking your credit report, reducing existing debts, and having a clear plan for the money you want to borrow. When considering places like Chase for low interest personal loans, we noted that big banks often offer competitive rates to those with strong credit and have pretty straightforward online application processes. We also explored other avenues, like online lenders and credit unions, as places where you might find good loan options, offering different benefits and application experiences. It is, in a way, about having choices and knowing where to look.

Finally, we covered the practical side of preparing for a loan application, including gathering identity and income proof, and having a good grasp of your current debts and expenses. Being organized and clear about your needs can make the application process much smoother. This whole process of seeking out a personal loan with a favorable interest rate is a bit like a personal quest, where preparation and knowing your options can lead to a successful outcome. It is, you know, about being informed and ready to make a financial move that truly helps you out.

- Iot P2p

- Turk If%C5%9Fa Sotwe

- Sotwe T%C3%BCrk If%C5%9Fa

- Device Management Remote Iot Management Platform Examples

- Sotwe Turk Ifsa